|

|

|

Here are some key points we must clarify for

2016 Obamacare:

What is Obamacare? – It is

totally different from Medicaid.

The Obamacare is not only for Medicaid or

Medicare. It is a reform of health insurance. In other words, if you already

received Medicaid or Medicare benefits before, you may ignore it. The Obamacare

is more focusing on people with compromised income, which have to buy by

themselves for health insurance, while, are not eligible for Medicaid benefits.

Who would get the most from

Obamacare?

The vast majority (86%) of Self-buyers of health

insurance will be the beneficiaries of Obamacare. There three type of

self-buyers: 1.) Self-employed individuals, include: agent

and brokers, doctors, contractors, etc. 2.) Small business owners, include: restaurant,

grocery store, beauty solons, various service stores, etc. 3.) Individuals and Workers without health

insurance, include: Non-W-2 (1099) employees, part-time workers, non-benefit

employees, unemployed individuals, etc. People on above list, according to the Obamacare,

if they do not meet Medicaid criteria, must buy health insurance by self, or

called self-buyers. However, lots of these people did not apply for Obamacare in

2015, since most of them believed they might be disqualified. Why? The main

reason was that they confused Obamacare with Medicaid and don't know they still have a chance to apply for tax credits,

which spent 5 minutes may save $5,000 or more. The other reason was that

some employers introduced a discounted health insurance to them, but did not pay

for at least 50% as benefits. In fact, the discounted insurance was not the

employer offered coverage, which did not block they to apply for Obamacare. What is the best way to apply

for Obamacare?

There are two ways to apply for 2015 Obamacare: 1.) Apply as individual and family (must input

all your income data). In Oregon, submit your application through a

federal agency called FFM, which is different from CoverOregon. In Washington and California, submit your

application to the state web portals, the same processes as last year. 2.) Apply as a small business owner or employees

(income data NOT required). All applications should submit to the FFM

portal. There is a special discount called SHOP for 2016. If a small business is

hiring at least one full time employee, but less than 25, and the business pay at

least 50% premium for health insurance of each full time employee, the owner can

get tax credits up to 50% of total contribution every month. No income data required.

Please note, this provides a great opportunity for owners and employees who as individuals

are originally disqualified for Obamacare due to their higher income. For example, a 58 old

doctor MD, owner of a clinic, made $195,000 net income in last year. He may be not qualified as individual for Obamacare this year, however,

he can apply for tax credits, as a small business owner, from the SHOP, which he can get tax credits up to

50% of all his contributions for his family and

employees health insurance. If the owner likes to share with the credits,

everybody in the clinic can also legally get 50% off for their health insurance. So, two ways, one to check income and the other one NOT

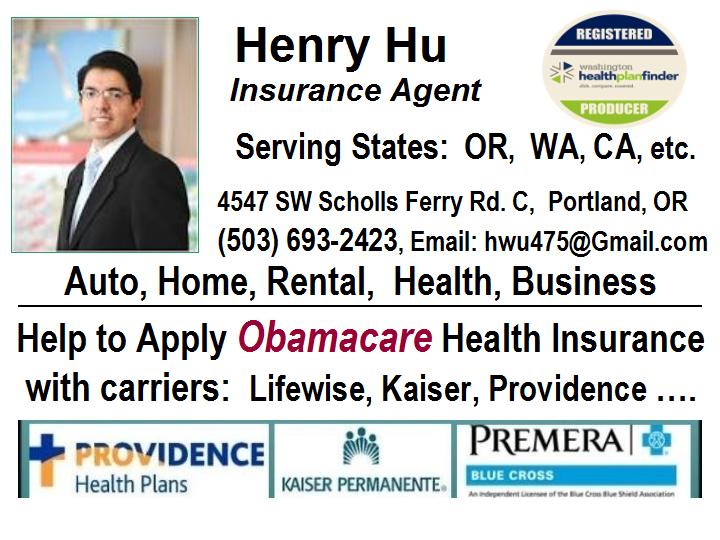

to check income. You must consult with

us to find a better way. In order to let us legally access your personal

information (like SSN, birthday, income, etc.), according to the US Privacy Law,

it is better that you may first select me, Henry Hu, as your insurance agent.

The easiest way to become your agent is that you choose one of our insurance

services including: auto, home, life, renters, business, etc. Please visit our

website for details. Actually, rules in Obamacare are very accommodated for these self-buyers (about 86%) to get financial aid for health insurance. The biggest reason for doing this is government would gain more benefits than loss, if people become self-employed, instead of claim unemployment funds. so that we can be pre-prepared to provide our best services for you. |